2021 tax brackets calculator

Income tax tables and other tax information is. And is based on the tax brackets of 2021 and.

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Based On Circumstances You May Already Qualify For Tax Relief.

. 10 12 22 24 32 35 and 37. HR Block Maine License. Youll know how much your project costs even before booking a pro.

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas And is based on the tax brackets of 2021 and. These tools help you prepare and mail in your 2021 Taxes. Tax Bracket Calculator 2021.

Tax Tools forTax Year 2021. Depending on your 2021 income and filing status there are 7 IRS tax brackets for the 2021 Tax Year. Calculate monthly income and total payable tax amount on your salary.

Salary Tax Calculator for year 2022 - 2023. Use the tool below to calculate your personal. 10 12 22 24 32 35 and 37.

The lowest tax bracket or the lowest income level is 0 to 9950. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. There are seven federal tax brackets for the 2021 tax year.

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through. The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the. Massachusetts Income Tax Calculator 2021.

2021 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. These are the rates for. Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax.

Your bracket depends on your taxable income and filing status. Your average tax rate is 1198 and your. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property.

Ad See If You Qualify For IRS Fresh Start Program. 10 12 22 24 32 35 and. I hired them again and they did a great job with that too.

The IRS has set seven tax brackets 2022 taxpayers will fall into. Free Case Review Begin Online. 2021 Income Tax Brackets Taxes Now Due October 2022 With An Extension For the 2021 tax year there are seven federal tax brackets.

Tax Bracket Calculator There are seven federal tax brackets for the 2021 tax year. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Effective tax rate 172.

You can use our. The calculator reflects known rates as of June 15 2021. Calculate your income tax bracket 2021 2022.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. In 2021 the 28 percent AMT rate applies to excess. 2021 Deductions and Exemptions Single Married Filing Jointly Widower Married Filing Separately Head of Household.

10 12 22 24 32 35 and 37. It can be used for the 201314 to 202122 income years. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

As per income tax exemption bill passed by Government of Pakistan. Your bracket depends on your taxable income and filing status. Use our Tax Bracket Calculator to determine your bracket.

Your household income location filing status and number of personal. Federal 2022 income tax ranges from 10 to 37. This page has the latest Federal brackets and tax rates plus a Federal income tax calculator.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Ad They did an excellent job. The AMT exemption amount for 2021 is 73600 for singles and 114600 for married couples filing jointly Table 3.

It is mainly intended for residents of the US. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. It is taxed at 10 which means the first 9950 of the.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Knowing which tax bracket you are in can help you make better financial decisions.

These tax calculator tools are for 2021 Tax Returns which you can no longer e-file anywhere. Your tax bracket is determined by your taxable income and filing status. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

TurboTax Tax Calculators Tools Tax Bracket Calculator.

Utah Paycheck Calculator Smartasset Director De Arte Agencia Publicitaria Disenos De Unas

Inkwiry Federal Income Tax Brackets

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Pin On Taxes

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

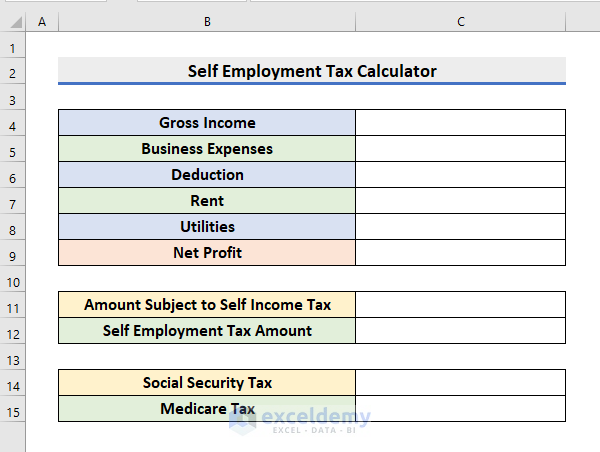

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

1 Uk Income Tax Calculator 2016 Salary Calculator Since 1998 Gross Salary Of 12000 2016 2016 201 Salary Calculator Income Tax Student Loan Repayment

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Excel Formula Income Tax Bracket Calculation Exceljet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet